News from: U.S. Chamber of Commerce

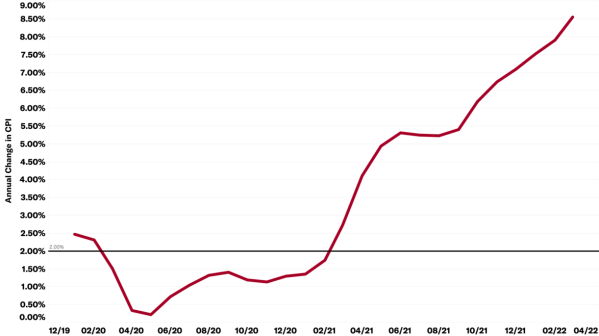

Today, the Consumer Price Index showed a 1.2% rise in the cost of goods and services from February, up 8.5% in the last year, with energy and food being the largest contributors to rising prices.

Why it matters: Inflation continues to chip away at Americans’ buying power and impact the larger workforce. Rising costs in housing, food, and energy are making it difficult for American families and businesses to get ahead.

- While monetary policy remains the best tool to fight inflation, policymakers should also be focusing on easing regulations, reducing tariffs, and increasing domestic energy production.

State of play: Rising energy costs continue to impact consumers and businesses, and the administration’s lack of commitment to increased production is hampering our ability to lower costs and improve energy security.

- The energy industry needs assurances from the administration that increased investment now will not be met with efforts to decrease or end production in the years ahead.

- It must end its ban on leasing on federal lands, expeditiously begin processing permits, and finalize a new offshore leasing program. Additionally, the U.S. must focus on approving critical energy infrastructure projects.

- And we must work to reduce emissions globally and transition to non-emitting energy sources. Policymakers must work with industry now to ensure our future energy security.

Be smart: We also remain concerned that the administration and some policymakers continue to blame businesses for rising prices.

- Inflation is the result of supply and demand. Pandemic-related shocks, a tight labor market, and loose monetary and fiscal policy have limited the supply of many goods and at the very same time boosted demand. This has created broad-based price increases.

Bottom line: To shift the blame to businesses is misguided and only increases the likelihood that the real causes of inflation will not be addressed, prolonging and exacerbating higher prices for families and risking a recession.

As expected, inflation surged again in March, rising at the highest rate since December 1981.

Details:

- Energy prices and higher food costs are driving prices higher. Gas rose 48% annually, electricity rose 11.1%, and food rose 8.8%.

- But even taking these more volatile prices out of the calculation, so-called core prices rose 6.5%. Those prices haven’t gone up that much since 1982.

- New cars are still up 12.5% annually, and used cars are up 35%.

Be smart: The prices of services still lag goods. Service prices rose a comparably light 4.7% annually in March.

- Lagging service prices are why we may have continued high inflation in the coming months. As the post-COVID economy continues reopening, increased demand for services will push up prices.

And: Keep an eye on housing prices. The cost of housing (rent and owner-occupied) rose 5% annually in March. But rental prices have not fully adjusted to the increase in home prices (19% nationally according to the Case-Schiller Index). Rents will rise as contracts adjust to reflect higher home prices. This will push overall inflation up.

—Curtis Dubay, Senior Economist, U.S. Chamber of Commerce