News from the US Chamber of Commerce

Thomas M. Sullivan, Vice President, Small Business Policy

Ryan Ellis, Forbes columnist, tax policy expert

Washington DC: As business leaders are all too aware, tax day happened last month – an annual occurrence dreaded by the nearly 30 million small business owners operating in the United States. Congress wanted to make April 15, 2019 less painful for businesses on Main Street and to give employees more money in their paychecks between now and then, and they did so by passing into law the “Tax Cuts and Jobs Act of 2017.”

Our biggest piece of advice for small businesses – right now – is don’t wait until 2019 to talk with your tax advisor or CPA about how you can benefit from tax reform that applies to this year’s earnings. Tax planning is part of what you are paying your tax professional to do for you, not just the annual chore of tax filing. Take advantage of his or her years of tax experience outside of tax season, when she will have more time to help you plan to keep more of your money in your business.

The new tax law provides several exciting developments for small business owners. But the first thing to remember is that many of the basic nuts and bolts of tax planning have not changed: quarterly estimated payments should be done as usual; the most common business expenses like legal and professional services, supplies and equipment, business travel, and business meals have virtually the same rules as before tax reform (but talk to your tax professional about entertainment expenses and state and local income tax deductions). There were zero changes made to self-employed retirement plans like SEP-IRAs and SIMPLES. There was no change at all, unfortunately, to the self-employment tax, the net investment income tax, or the additional Medicare surtax.

Here are some of the things that have changed. First, income tax rates have come down across the board for all small business owners. What was a six bracket structure ranging from 10% to 39.6% is now a seven bracket structure ranging from 10% to 37%. In between those low and high rates, brackets are wider and rates are lower than before.

Qualified business income

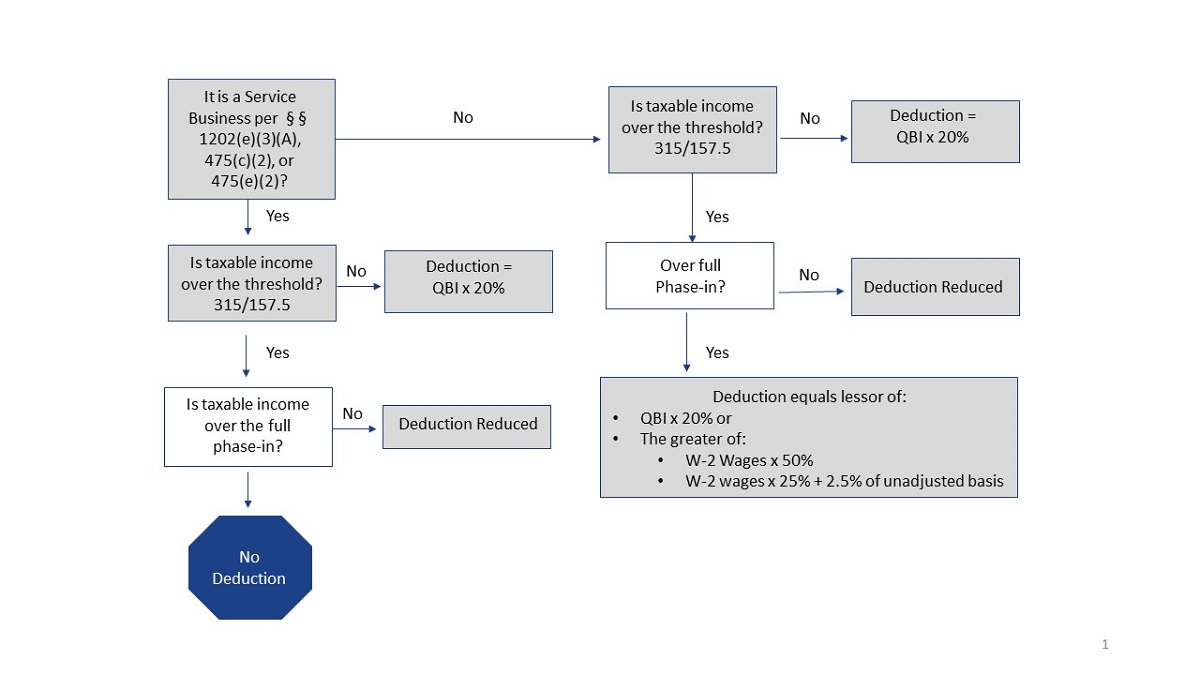

In addition, Congress has created a further de facto rate reduction for small business owners. It’s known as the “qualified business income” (QBI) deduction, and it’s gotten a lot of attention. Because this is taxes, it’s a little complex. The best way to think of it is to envision two separate sets of QBI rules: one for businesses in households making less than $315,000 in taxable income (income after accounting for all deductions, including itemized deductions) per year, and one for everyone else.

If you’re married and your taxable income is less than $315,000 per year ($157,500 if you’re not married), the QBI rule is very simple: take your business profit (that is, net profit from a trade or business that flows from your Schedule C, E, or F) and claim a deduction for 20% of that amount. Simple and easy. Your business profit’s tax rate is thereby reduced by 20%.

It gets slightly more complicated if you’re just north of this income level. The 20% QBI deduction phases out ratably as your taxable income approaches $415,000 if married ($207,500 if single).

It doesn’t matter what type of business you are in. It doesn’t matter if you have employees or not. You just get it. The great majority of small business owners will be able to claim this simple deduction as described above.

Flowchart to determine if a business qualifies for the qualified business income (QBI) tax deduction.

The “alternate” QBI is for more mature small businesses whose profits and other income put their 1040 taxable income north of this range. For these businesses and only these businesses, there are “guardrails” to deal with. Why did Congress put these in? The fear was that sophisticated, high income wage earners would convert their W-2s into business 1099s and claim the QBI deduction in an attempt at tax evasion.

The first “guardrail” is that your business cannot be in a specified service trade. In English, that means a business in the fields of health, law, accounting, actuarial sciences, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners.

If you’re passed the first guardrail, it’s onto the second – the wages test. The QBI deduction for mature, non-service businesses is the lesser of 20% of profit, or half the W-2 wages paid by the business. The idea here is to require that businesses actually be more than just earnings mechanisms for owners. It’s another way of testing to make sure that a business is not just a hidden salary of a sophisticated taxpayer in search of a QBI deduction. If a non-service business carries a sizeable payroll, chances are you’re in the clear for a QBI deduction.

Suppose you don’t have a lot of wages? Well, there’s another way to pass the second guardrail. The other way is to have a QBI deduction equal to the lesser of 20% of profit, or the sum of one-quarter of W-2 wages paid plus 2.5% of the unadjusted basis of qualified property. This alternate equation will be most useful to companies that have a lot of assets (especially real estate assets), but not a heavy payroll burden.

If a mature business passes through these two guardrails – the service income test, and the wages paid test – they qualify for a QBI deduction. Assuming their business income is taxed at the top rate, that means a tax rate cut on business income from 37% all the way down to 29.6% (the lowest rate since the 1986 Tax Reform Act).

Whew! If your vision is blurry or if your brain is exhausted at this point, that’s why our biggest piece of advice is to talk with your tax advisor or CPA. The sooner the better! It’s important to note that all businesses will receive tax relief under the tax reform law, even those who don’t get a QBI deduction. The worst case scenario for a top tax rate business is that their business income tax rate declines from 39.6 percent under the old law to 37 percent today.

Tax professionals are boning up on these rules as we speak and business advocacy organizations like the U.S. Chamber of Commerce are pressuring IRS to issue guidance that will help. Please, please, please make some time to meet with your trusted advisor. If you do, next April should be less painful.